Nowhere is the divide between dental offices that leverage tech and those that don’t as great as it is with insurance billing. Research presented by the Council for Affordable Quality Healthcare (CAQH) shows nearly 80% of dental offices are sending electronic claims, yet even within the tech adopters, a great many aren’t using it to its fullest. That’s concerning, as moving to electronic claims with integrated attachments can make practices more profitable and eliminate unnecessary frustrations for the front office.

Below, we’ll break down exactly how the tech works, explore how it can be used to streamline many dental insurance processes and boost practice profit, plus show you how it works in an integrated practice management system.

What’s Dental EDI?

Electronic Data Interchange (EDI) is the formal term for a computer-to-computer exchange of data. In the dental industry, it’s usually used in relation to insurance processes and eliminates the need for paper documents. The ADA supports the use of HIPAA-compliant EDI transactions and, as can be seen by CAQH data, it has been adopted by most practices to some degree.

You may be more familiar with it in terms of clearinghouses. If your office runs on Practice-Web, chances are you use ClaimConnect by DentalXChange as your EDI provider. However, we also support many other clearinghouses, such as Change Healthcare, Tesia, Electronic Dental Services, Apex, Vyne, and more.

There Are Various Types of EDI Transactions

With full adoption of EDI, the dental industry would save an estimated $125 million according to CAQH research. Around $80 million would go directly to providers, while insurance companies would save a further $45 million. We’ll explore the facets of full adoption below.

Insurance Eligibility and Benefits Checks

Per CAQH estimates, nearly 200 million dental eligibility and benefit verifications are performed every year. It takes a typical practice 23 minutes for each verification when handling it manually, but the time drops to just nine minutes for those using EDI. Only 46% of offices are using this massive time-saver though.

With Practice-Web’s EDI integration, you can obtain real-time eligibility on demand or set the system to check benefits in advance of appointments, then select the benefits you’d like to import automatically. This allows you to avoid lengthy calls to insurance companies and eliminate manual entry.

Pre-Authorizations

It takes healthcare providers an average of 16 minutes to manually submit a pre-authorization to an insurance company per CAQH. The total drops to nine with EDI.

Dental Insurance Claims Submission

Dental offices send around 177 million claims each year according to CAQH. Thankfully, these are normally done in batches and most don’t require special documentation, so it only takes an average of four minutes to submit each one manually. EDI drops it down to three minutes, but the savings really add up when you consider how many claims your office sends.

Claim Status Checks

From 2017 to 2018, the number of claim status inquiries rose from 24 million to 77 million! What’s more, CAQH data shows 91% of offices are performing this task manually, taking 14 minutes on average. With EDI, it takes about five.

Remittance Advice

Electronic Remittance Advice (ERA), or 835, provides claim payment information. CAQH research shows dental providers examine EOB info 132 million times per year. This takes an average of six minutes each time; a span that’s halved with EDI. With EDI, you can view a full history of sent claims and reports from a single dashboard too.

Dental Insurance Payments

Just 12% of dental practices receive their insurance payments and EOBs electronically. Processing alone takes a typical practice five minutes per EOB according to CAQH. EDI only shaves about a minute off this, but the real benefit here is that it means the practice gets paid in 3-4 days with electronic funds transfer rather than the 13-14 days it takes to get paid with manual claims processing. It’s a huge help for maintaining healthy cash flow and eliminates trips to the bank.

It’s worth noting that ClaimConnect, Practice-Web’s preferred clearinghouse, is the only one that offers real-time claims processing for Met Life claims. You can literally get an EOB from them within minutes of your submission.

Integrated Attachments Are a More Recent EDI Development

One of the big reasons some dental offices have held off on incorporating EDI into their practices is the need to send documentation along with certain types of dental claims. Until recently, even offices leveraging electronic claims still had to print and mail claims for common procedures like crowns, implants, and perio work. However, advancements in EDI now make it possible to send required documentation electronically with the claim, so there’s no need to ever use snail mail as long as you have tools like digital x-rays, paperless dental practice software, and a scanner.

If you’re using ClaimConnect with Practice-Web, the ability to send attachments is integrated into your software. You can attach documents with just a few clicks and the program will even alert you when you need to provide documentation based on the procedure and insurance company.

The Options Are Endless with Integrated Attachments

You can send virtually any file type as an attachment. A few common examples include:

- X-Rays

- Intraoral Photos

- Pero Charting

- Narratives

- Primary or Secondary Insurance Documentation

- EOBs

- Pre-Authorizations

There Are Many Benefits to Using Electronic Attachments

Electronic attachments are one component of EDI transactions that dental offices should use if they want to achieve maximum benefit. Again, practices throughout the country will save $80 million in total with full adoption.

- Cuts Mailing and Postage Costs

- Increases Productivity/ Saves Time

- Speeds Up Claims Processing (3-4 days vs 12-14 days)

- Improves Cash Flow

Integrated EDI is Better

Not all dental practice software leverages EDI to its fullest. In fact, some don’t even offer it at all. That means dentists are stuck processing everything manually, piecemealing processes, or purchasing expensive third-party software. For some, it’s such a big, tangled mess that they just give up and outsource all their insurance billing—another unnecessary expense.

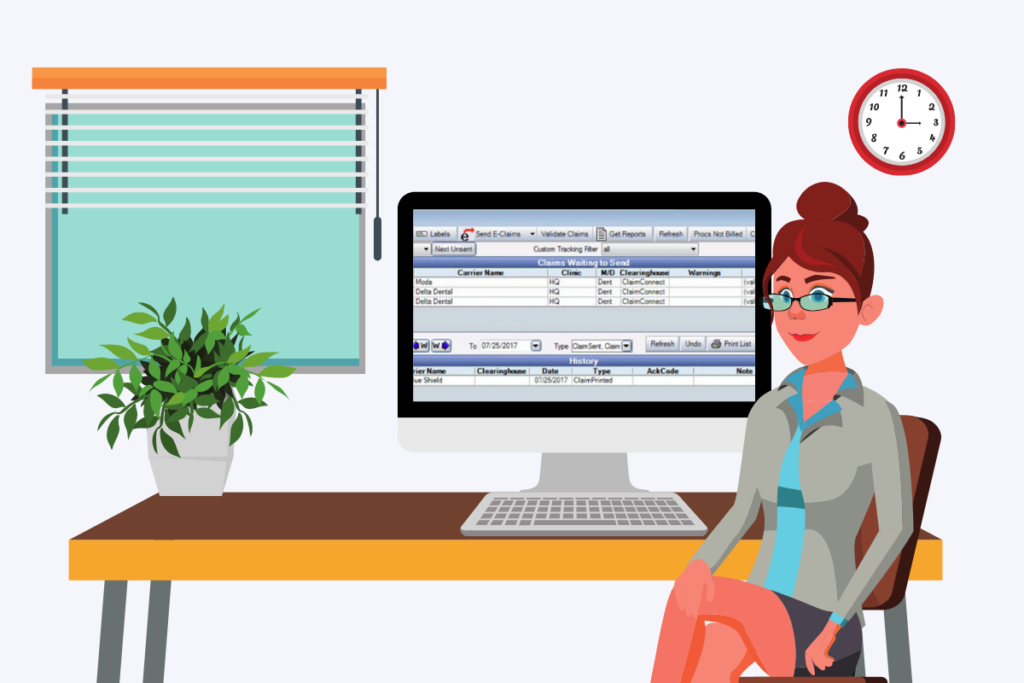

It’s much better when your EDI program integrates with your practice management software. When you use software like Practice-Web that integrates EDI and attachments, you benefit even more.

- Data is Shared Between Systems

- Processes Streamlined Through In-Workflow Tasks

- Manual Entry is Minimized

- Efficiency Increases

- No Expensive Third-Party Software

- HIPAA Compliance

Practice-Web is EDI-Friendly, So Your Office Can Thrive!

Dedicated to helping dentists thrive, Practice-Web is proud to provide dental offices with the best EDI has to offer, so you can operate more profitably and efficiently. We also do it at a fraction of the cost other providers charge. Visit our eClaims and Eligibility Check Smart Tools page for more details or contact us if you’d like to switch to Practice-Web or need help enabling EDI in your Practice-Web software.

Pingback: 4 Key Dental Practice Metrics to Track & Improve – Practice-Web Thrive Blog

Pingback: Getting Insurance Plans to Play Nice: Insurance Plan Types vs Fee Schedule Types – Practice-Web Thrive Blog

Pingback: Getting Insurance Plans to Play Nice: Insurance Plan Types vs Fee Schedule Types | Thrive Blog

Pingback: 4 Key Dental Practice Metrics to Track & Improve | Thrive Blog

Pingback: 6 Powerful Ways to Boost Production & Profit Before Year End | Thrive Blog

Pingback: 5 Ways to Be Productive (and Boost Revenue) When Your Office is Closed! | Thrive Blog